COMMERCIAL FINANCE AND RENTAL

FLEXI COMMERCIAL

APPROVAL

REQUIRED

Acquire business-boosting assets now without draining your cash flow. Leasing frees up lines-of-credit and other sources of funding so you can keep your business ticking along while benefiting from the innovation and efficiency that the leasing of new equipment provides.

How It Works?

FlexiCommercial offers your business flexible equipment finance solutions. Our Credit Criteria for Finance vary depending on whether you are an existing or new business and the required amount of finance.

There are five simple steps to getting the finance you need today:

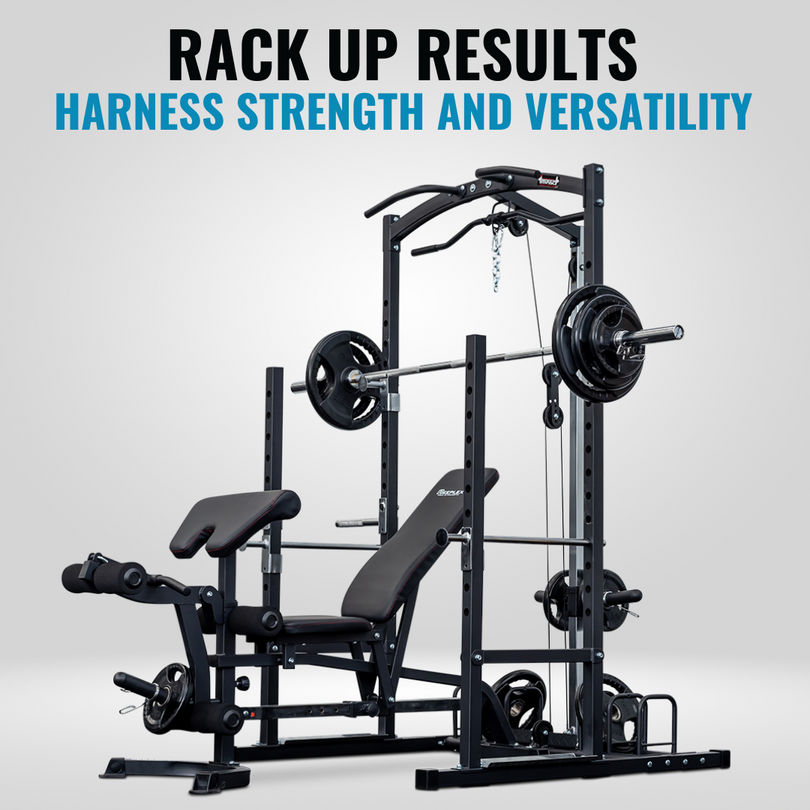

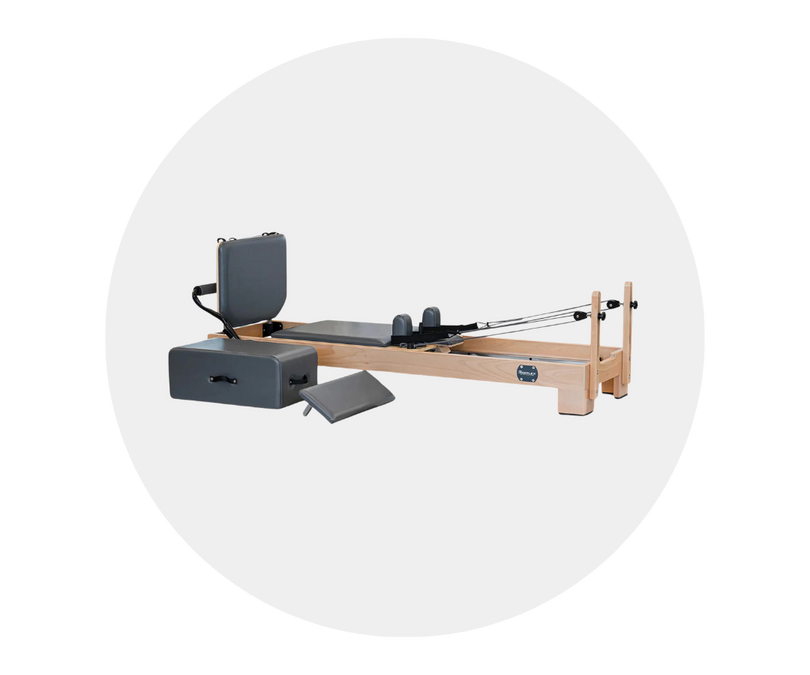

1. Choose the equipment you need. We can connect you with our network of partners which comprises the top suppliers in most industries.

2. Choose the type of lease and terms that best suit your needs.

- With an Operating Lease you pay for the use of the equipment; or

- With a Finance Lease you pay a pre-determined residual amount at the end of the lease term so you own the equipment outright.

3. Select from a wide choice of payment terms to best suit your budget. Choose a 12, 24, 36, 48 or 60 month term.

REMEMBER, THE LONGER THE TERM, THE SMALLER THE MONTHLY REPAYMENT.

4. Apply online, over the phone or through your supplier in store. It typically takes minutes to make an application for your finance.

5. Sign and return the paperwork, once you have finance approved, and arrange to have your new equipment delivered to your workplace or take it with you.

Now you can leverage your new assets for business efficiency, competitive advantage and growth.